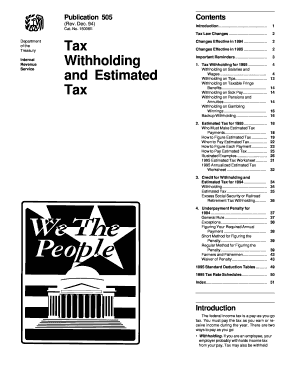

Publication 505 (2024), Tax Withholding and Estimated Tax

4.6 (364) In stock

Publication 505 - Introductory Material Introduction Nonresident aliens.

Your Questions on Estimated Tax Payments, Answered - WSJ

Two Ways Household Employers Can Avoid Estimated Tax Penalty

Issues with Past Tax Returns: Should I Submit Amended Tax Returns?

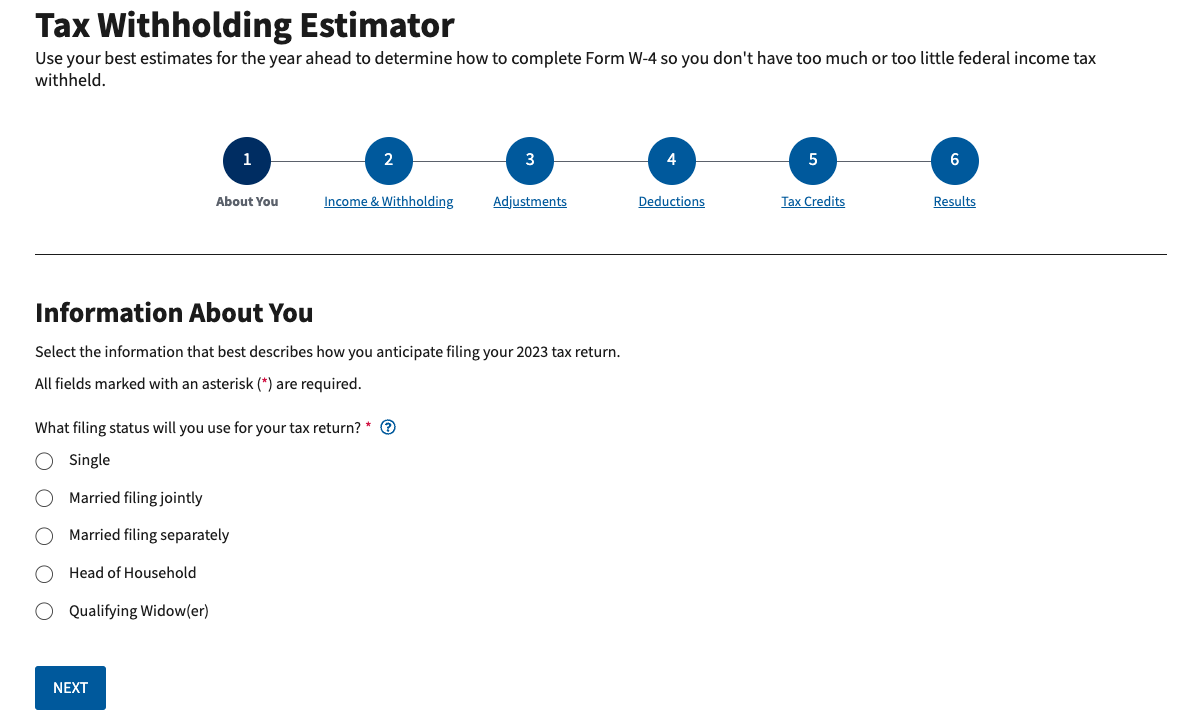

IRS Tax Withholding Estimator

How does a W-4 *exactly* affect your federal tax withholdings? I understand how additional exemptions reduce withholding, but is there a place to check exactly how your withholdings are affected, by either

Adjusting Your Tax Withholding - Coastal Wealth Management

The C-Corporation Advantage : Qualified Small Business Stock Exclusion

Publication 505 (Rev - Fill and Sign Printable Template Online

How to decrease my withholding in new W4? Like in the old system it was easy enough making the claims 0 to 1. I just want my paycheck to be increased, is

Estimated taxes: Why, when, and how to pay them - Don't Mess With

When I fill out my tax information for a new employer, what do I

What to Know About 2024 Tax Withholding and Paying Estimated Taxes

Healthy Eating When You Have COVID-19 - ChristianaCare News

Can You Eat Dried Fruit If You Have Diabetes?

How to Know If You Have Tinnitus - Sound Relief Hearing Center

7 foods to avoid if you have heart palpitations

Infographic: COVID-19. Ways to prepare and protect yourself if you

Women's Physiological Panty: High Waist, Hip Wrap, Oversize Underwear, 4-Layer Women's Physiological Underwear, Postpartum Oversize Briefs - China Underwear and Lingerie price

Women's Physiological Panty: High Waist, Hip Wrap, Oversize Underwear, 4-Layer Women's Physiological Underwear, Postpartum Oversize Briefs - China Underwear and Lingerie price You can now buy Victoria's Secret underwear on

You can now buy Victoria's Secret underwear on Bootcut Bengaline Trousers

Bootcut Bengaline Trousers lululemon athletica, Bags, Lululemon Java Belt Bag

lululemon athletica, Bags, Lululemon Java Belt Bag- Pull-Ups Girls' Potty Training Pants, 3T-4T (32-40 lbs) - The Fresh Grocer

Martha Tulle with Appliqued Long Sleeves Dress-Sky Blue Plus Size | BABARONI

Martha Tulle with Appliqued Long Sleeves Dress-Sky Blue Plus Size | BABARONI