The Invesco QQQ ETF Is Finally Ready to Join the Rally

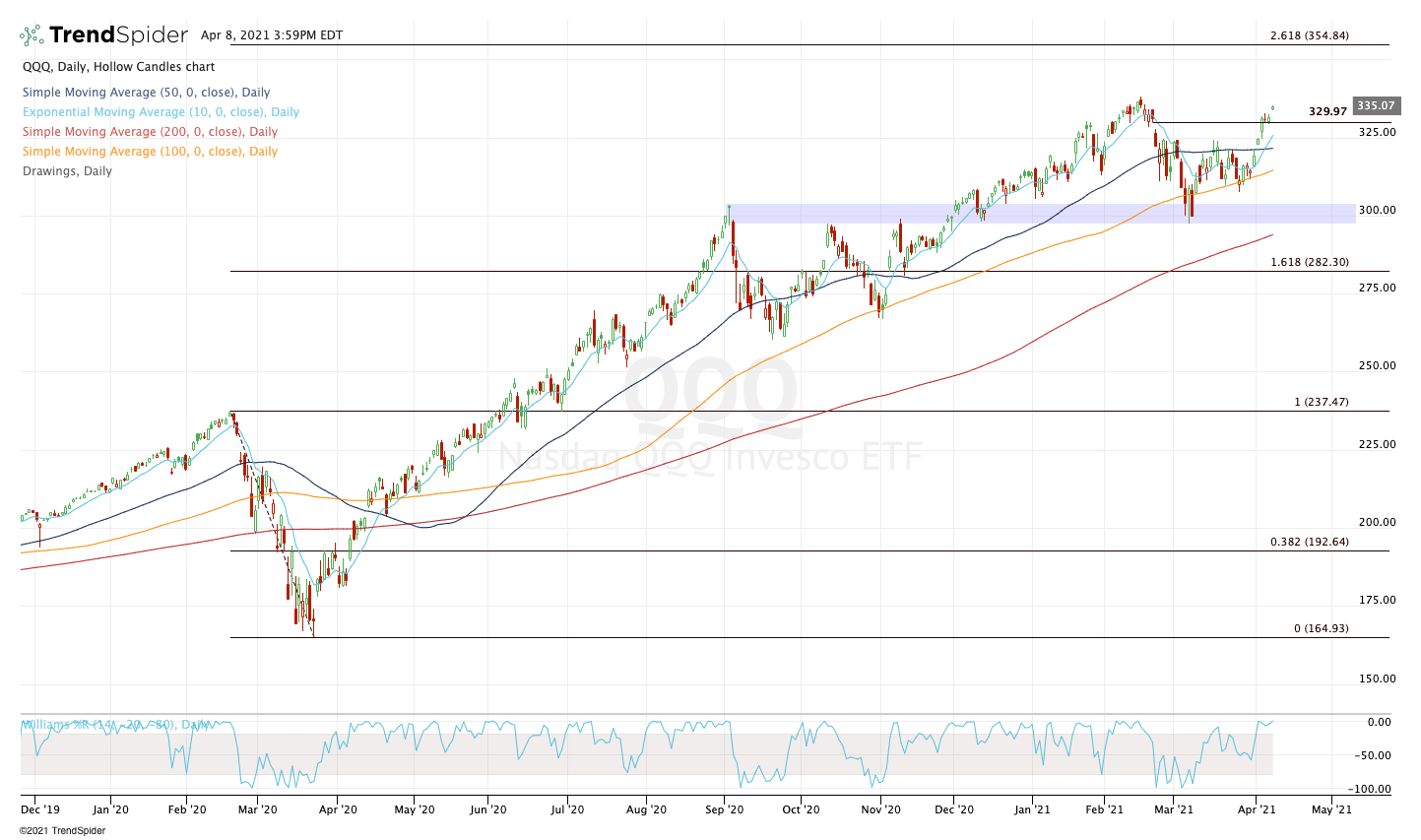

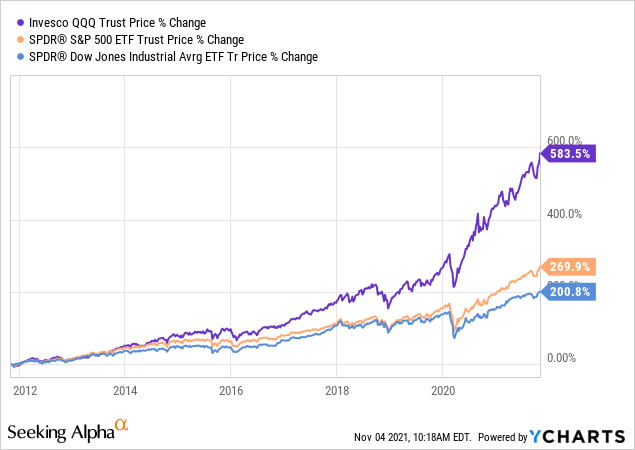

4.8 (553) In stock

While the S&P 500, Dow Jones and Russell 2000 were busy making new highs, the Nasdaq was left behind. The Invesco QQQ ETF (NASDAQ:QQQ) was getting hit as tech stocks were roughed up. QQQ stock lagged as a result, but you can’t keep this group down forever. Source: Shutterstock Think of it like a basketball in the water. You can pull it below the surface for brief periods. You can even really drive it down if you try. But after a while, it rockets back to the surface and breaks back above the water. InvestorPlace - Stock Market News, Stock Advice & Trading Tips That’s sort of like QQQ stock. It can lag the broader market at times and can even see bigger losses than the general market during a correction. However, this exchange-traded fund is a leader and it can only be held back for so long. From Laggard to Leader? Click to EnlargeSource: Chart courtesy of TrendSpider The QQQ ETF has lagged behind its peers, as the Nasdaq has lagged the other indices. That’s largely to blame on two things, though. First, while growth stocks roared higher to start the year, this group went on a painful slump. Unfortunately, that happens with growth stocks. These names run long and far — oftentimes doubling or tripling along the way — then suffer 30% to 50% pullbacks. It’s just the nature of the growth-investing game. However, more times than not, these pullbacks tend to be buying opportunities. The second reason QQQ stock underperformed? FAANG. While FAANG is a notable component in other indices too, the group doesn’t have as heavy of a weighting as it does in the QQQ. This group — and large-cap tech stocks in general — have been consolidating for months. Although sideways price action doesn’t negatively impact the QQQ ETF necessarily, it doesn’t help it. At a time where high-growth stocks are under pressure, the QQQ desperately needed FAANG and other large-cap tech stocks to bail it out. When they couldn’t, the Nasdaq and the QQQ were susceptible to larger declines. 7 Safe Stocks to Buy for Uncertain Times However, we’re getting a nice rally in high-growth stocks as the group tries to bottom. FAANG and other mega-cap tech stocks have turned around too. Several are hitting new all-time highs. Those that haven’t are trading better too. Perhaps investors are rotating out of value stocks and looking for more growth. Maybe they feel this group is too cheap. Or perhaps it’s investors getting bullish ahead of earnings. Whatever the reason, it doesn’t matter. It bodes well for QQQ stock as the Nasdaq and tech make a comeback. Now let’s see if it can make new highs. QQQ Stock vs. Its Peers The market has a way of ebbing and flowing. But regardless of how those ebbs and flows go, the QQQ isn’t not something that should be neglected. For starters, despite its recent underperformance, it tends to be a big-time out-performer. Up 67% in the past 12 months, the QQQ trounces the S&P 500’s 47% gain (although that’s still respectable). Over the last three and five-year periods, the outperformance grows. The QQQ is up 114% and 207% in that stretch, while the S&P 500 is up 57% and 100%, respectively. We’re not here to beat up on the S&P 500. In fact, I like the index and feel that having exposure to that group of stocks is a good thing. However, the QQQ simply provides more “oomph” for investors. Others will critique it as risk vs. reward, that in order to get those big returns, investors must accept higher risk. They argue that the QQQ is a riskier holding than the S&P 500. But is it? Amid the novel coronavirus correction of 2020, QQQ stock sank 30.55%, while the S&P 500 fell 35.4%. Granted, that’s just one data point. However, it shows that the QQQ’s exposure to some of the market’s strongest companies and brands didn’t leave it overexposed and at risk, it insulated it to some degree against the broader market’s decline. In other words, it’s weighing was an asset, not a liability. I love that investors can add or subtract tech exposure in a pretty quick manner with the QQQ as well. The fact that it’s not a risky volatile asset in down times, yet outperforms on the upside means it’s a holding every investor should consider. On the date of publication, neither Matt McCall nor the InvestorPlace Research Staff member primarily responsible for this article held (either directly or indirectly) any positions in the securities mentioned in this article. Matthew McCall left Wall Street to actually help investors — by getting them into the world’s biggest, most revolutionary trends BEFORE anyone else. Click here to see what Matt has up his sleeve now. More From InvestorPlace Why Everyone Is Investing in 5G All WRONG It doesn’t matter if you have $500 in savings or $5 million. Do this now. Top Stock Picker Reveals His Next Potential 500% Winner Stock Prodigy Who Found NIO at $2… Says Buy THIS Now The post The Invesco QQQ ETF Is Finally Ready to Join the Rally appeared first on InvestorPlace.

While the S&P 500, Dow Jones and Russell 2000 were busy making new highs, the Nasdaq was left behind. The Invesco QQQ ETF (NASDAQ:QQQ) was getting hit as

The Invesco QQQ ETF Is Finally Ready to Join the Rally

Invesco QQQ Trust ETF Forecast for End of 2024

Cornerstone Advisors LLC Purchases 29,000 Shares of Invesco QQQ (NASDAQ:QQQ)

Small-Cap Rally Augurs Well for This ETF

Page 91 Ideas and Forecasts on ETFs — TradingView

QQQ: Be Prepared For The Biggest Tech Rally In Your Lifetime (NASDAQ:QQQ)

Invesco Nasdaq ETF ($QQQ) Reacted Higher After a Corrective Pull Back.

Fed Pivot Or Pushback? Markets Poised For Tense Policy Finale To 2023

Before You Buy the Invesco QQQ Trust ETF, Here Are 3 I'd Buy First

Invesco QQQ ETF Price — NASDAQ:QQQ — TradingView — India

Why Investors Should Reduce Holdings On Invesco QQQ

Invesco QQQ Trust (QQQ) Shows Resilience With Strong Technical Performance

WORLD'S BEST LONG DRIVE GRID? Long Drive's Yankee Stadium

WORLD'S BEST LONG DRIVE GRID? Long Drive's Yankee Stadium- Faja Larga🇨🇴 Size S 📱829-209-4690 - Lala's Fashion District

Torna-se conhecido o dia de chegada ao Brasil do novo maior avião da Força Aérea Brasileira

Torna-se conhecido o dia de chegada ao Brasil do novo maior avião da Força Aérea Brasileira Micro Apartments - The Modern Living Space Of The Urban Metropolis

Micro Apartments - The Modern Living Space Of The Urban Metropolis Men's Heated Hunting Jacket with Battery & Detachable Hood

Men's Heated Hunting Jacket with Battery & Detachable Hood HAY Check Cotton Bath Mat - Cappuccino – MoMA Design Store

HAY Check Cotton Bath Mat - Cappuccino – MoMA Design Store