Building the Case: Low-Income Housing Tax Credits and Health

4.9 (230) In stock

The Low-Income Housing Tax Credit (LIHTC) provides tax credits to private investors to support the development of affordable, multifamily housing. Since its inception, the…

Series: Low Income Housing Tax Credit Spending Difficult To Track

The Homeownership Society Was a Mistake - The Atlantic

Understanding and Addressing Racial and Ethnic Disparities In Housing

Building the Case: Low-Income Housing Tax Credits and Health

Annual property tax - Province of British Columbia

Caitlin Krutsick - Waxman Strategies

Low-Income Housing Tax Credit, Housing Program

The Effects of the Low-Income Housing Tax Credit (LIHTC) - TAAHP - Texas Affiliation of Affordable Housing Providers %

Brian Ewing (@RED_BrianEwing) / X

Building Affordable Rental Housing in Unaffordable Cities: A

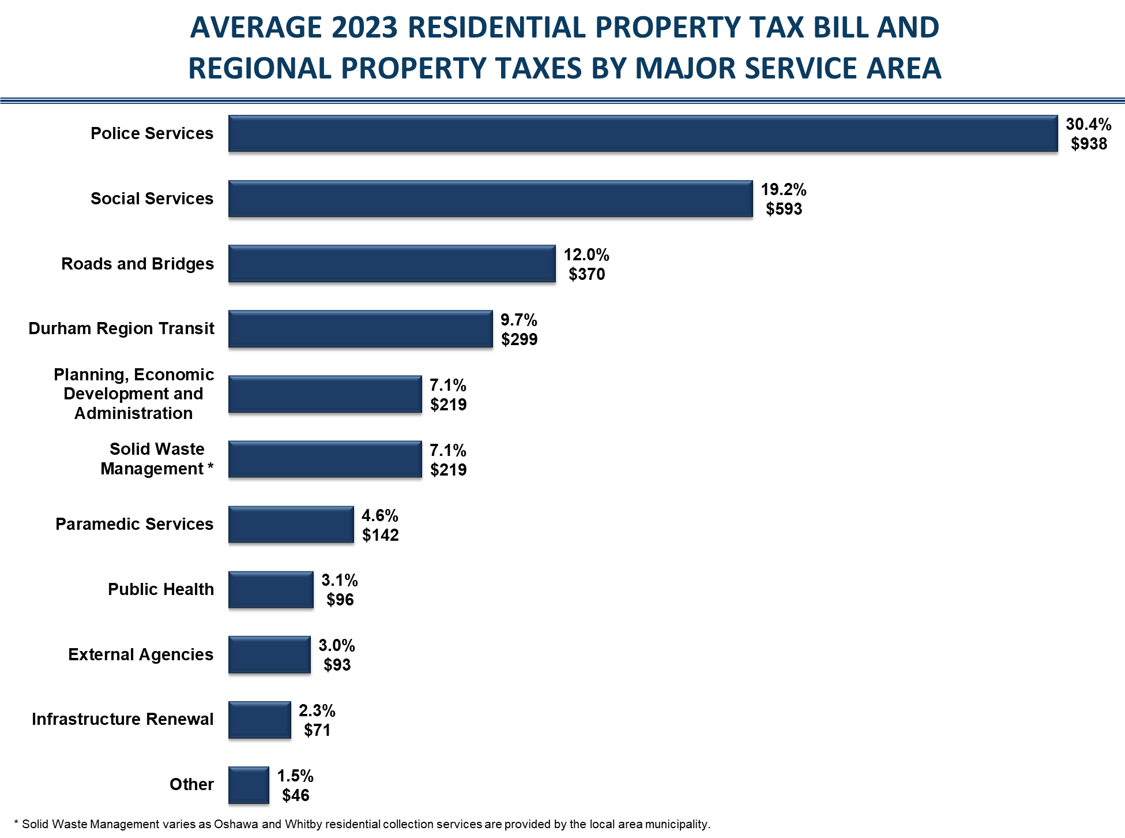

Property Taxes - Region of Durham

Multifamily Series: How Affordable Housing is Changing

National Low Income Housing Coalition - Wikipedia

A Frayed and Fragmented System of Supports for Low-Income Adults

Basic Facts About Low-income Children, 2010: Children Under Age 18 – NCCP

Low-income families are getting terrible financial advice online - MarketWatch

Poor Family Concept, Despair, Helpless. Low Income Stock Image - Image of finance, home: 147184219

Girls Frappe Seamless Leggings, Girls Leggings

Girls Frappe Seamless Leggings, Girls Leggings Boyoo Girls 2PCS Tracksuit Athletic Sweatsuits Sets Zip-up Hooded

Boyoo Girls 2PCS Tracksuit Athletic Sweatsuits Sets Zip-up Hooded- Ann Summers Bra Size 34D New with Tags EU 75D Red Sexy Lace 2 Range Plunge

Virah Bella - Sunshine - Lightweight Reversible Quilt Set with Decorat – Duke Online

Virah Bella - Sunshine - Lightweight Reversible Quilt Set with Decorat – Duke Online It's a Wrap! in Ivory Linen – HelloMyGoddess

It's a Wrap! in Ivory Linen – HelloMyGoddess- Mom High-Waisted Jeans Levi's® 26986-0026