What is 80D for senior citizens

4.6 (307) In stock

What can be claimed under Section 80D? - Quora

✳️Income Tax Deductions related to Health 🩺 Deduction for Medical Insurance and Preventive Health Check-up (80D) 🩺 Deduction for Medical Treatme - Thread from CA Garima Bajpai @garimabajpai - Rattibha

My father is senior citizen and mother is not, what is the maximum amount I can claim for their insurance under parental insurance tax exemption? - Quora

Get Health Insurance Coverage to Save Tax, by Master Capital Services Ltd

Stories

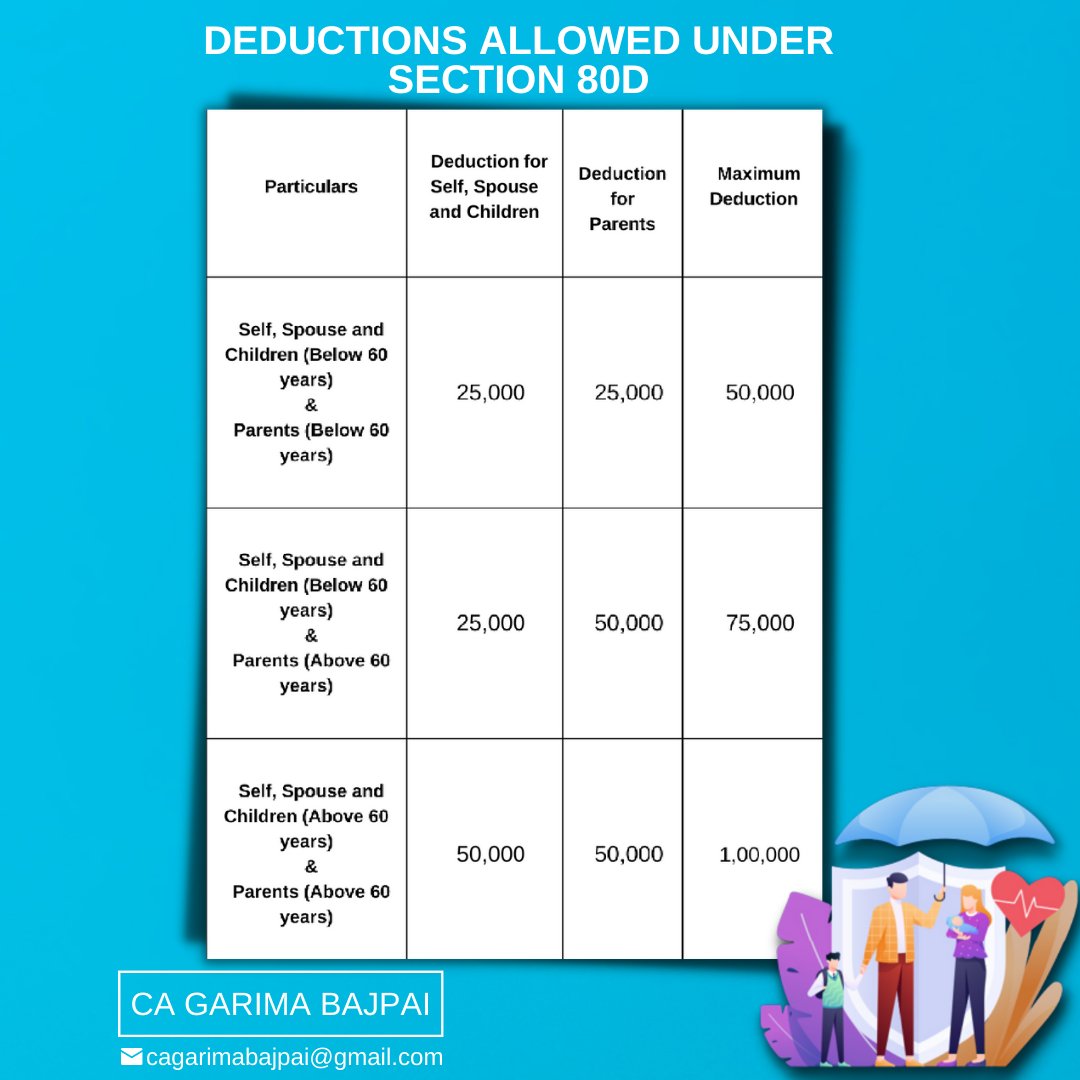

Section 80D Tax Deductions: Tips For Individuals & HUFs TAXCONCEPT

CA Chirag Chauhan on X: Know how much you can claim Medical Insurance premium paid deduction in 80D for family & senior citizens You can also claim Medical Expenditure on health of

Star HealthInsurance on X: Tax Benefits on Star Health Insurance Under Section 80D of Income Tax Act. Tax Exemption Yearly Upto Rs.55000. Self - Rs.25000. Parents - Rs.30000. Policy Available for Individual

Health insurance deductions for senior citizens under Section 80D, Fincart Financial Planners posted on the topic

Section 80D limit increased to Rs 50,000 for senior citizens

How can Senior Citizens save money on taxes by using Section 80D to deduct medical bills?

Senior Citizen Benefits in Philippines

What age Is 'senior citizen'? Is there an 'official' age in

Empowering Senior Citizens: The Benefits of Visiting a Senior

Senior Citizen? Do you know about this facility? Your bank must

GHFK Yoga Pants Women's Sexy Women Running Yoga Pants Breathable Knitted Leggings Girls Leggings High Waist Push Up Sports Workout Running Tight-Pink_S : : Fashion

GHFK Yoga Pants Women's Sexy Women Running Yoga Pants Breathable Knitted Leggings Girls Leggings High Waist Push Up Sports Workout Running Tight-Pink_S : : Fashion BBW Lotions Her Big Tits Video

BBW Lotions Her Big Tits Video Lesklé legíny • cena 12,99 € • obchod bonprix

Lesklé legíny • cena 12,99 € • obchod bonprix The North Face Seasonal Graphic HD Hoodie (brandy brown)

The North Face Seasonal Graphic HD Hoodie (brandy brown) Yuyuzo Womens Business Casual Pants Straight Leg High Waisted Work Pants Solid Color Office Ladies Formal Pants

Yuyuzo Womens Business Casual Pants Straight Leg High Waisted Work Pants Solid Color Office Ladies Formal Pants Under Armour Women's UA ColdGear Infrared EVO Legging XL

Under Armour Women's UA ColdGear Infrared EVO Legging XL